HS Classification, Import Quotas, and Seafood Legality Compliance

- Executive Summary and Key Takeaways

- Common Judgment Errors in Practice

- The Three Key Decision Axes for Squid Imports

- Practical Import Decision Flow (Simplified)

- Import Quota Procedures and Customs Clearance Flow

- Seafood Legality Compliance Checklist

- Common Compliance Failures

- Practical Summary

- Practical Q&A

- References

Executive Summary and Key Takeaways

When importing squid into Japan, it is critical to understand that all squid imports—whether raw materials or processed products—are subject to Japan’s seafood legality and traceability framework, commonly referred to as the Seafood Distribution Properness Scheme (Japan’s IUU control regime).

While import quota (IQ) regulations apply only to raw squid classified under HS Chapter 03, processed squid products under HS 1605 are not exempt from compliance. For commercial imports, importers are generally required to verify and submit documentation proving lawful harvesting, such as Catch Certificates and Processing Statements.

In practice, many importers mistakenly assume that “non-quota items require no procedures.” Failure to comply with seafood legality requirements can directly lead to customs clearance suspension, corrective orders, or even termination of ongoing trade relationships.

Therefore, the fundamental rule in squid import operations is to assess the following three elements together:

- HS classification

- Applicability of import quota regulations

- Applicability of seafood legality and traceability requirements

Common Judgment Errors in Practice

In day-to-day import operations, the following mistakes are frequently observed:

- Assuming that processed products are exempt from both import quotas and legality compliance, and importing without certificates

- Mixing frozen raw squid and heat-processed products in one shipment and handling HS classification and compliance collectively

- Believing that Catch Certificates apply only to raw materials, and clearing processed products without documentation

The reason there is no single, uniform answer is that squid imports are subject to multiple overlapping regulatory regimes, depending on their physical state, degree of processing, and intended use.

Since 2022 in particular, seafood legality compliance has become a baseline requirement, making the former approach of “checking quotas only” no longer sufficient.

The Three Key Decision Axes for Squid Imports

Decision Axis 1: HS Classification and Import Quotas (Traditional Focus)

| Category | Main HS Chapter | Import Quota | Practical Position |

|---|---|---|---|

| Fresh / Frozen Raw Squid | HS Chapter 03 | Applicable | Import quota approval generally required for commercial imports |

| Prepared / Processed Squid | HS 1605 | Not applicable | No quota required, but other regulations apply |

Up to this point, traditional understanding remains valid.

Decision Axis 2: Applicability of Seafood Legality Regulations (Most Critical in Recent Years)

Squid is designated as a regulated aquatic species under Japan’s seafood legality and traceability framework, which aims to prevent IUU (Illegal, Unreported, and Unregulated) fishing.

Key points:

- Coverage is not limited to HS Chapter 03

- Processed products under HS 1605 are also included

- Commercial imports are generally required to comply

👉 The assumption that “non-quota items are exempt from seafood legality requirements” is incorrect.

Decision Axis 3: Practical Compliance by Import Type

| Import Type | Import Quota | Seafood Legality Compliance | Practical Assessment |

|---|---|---|---|

| HS 03 Raw Squid (Commercial) | Required | Required | Most heavily regulated |

| HS 1605 Processed Squid (Commercial) | Not required | Required | Frequently overlooked |

| Small-Quantity Samples | Generally not required | Case-by-case | High risk if later converted to commercial use |

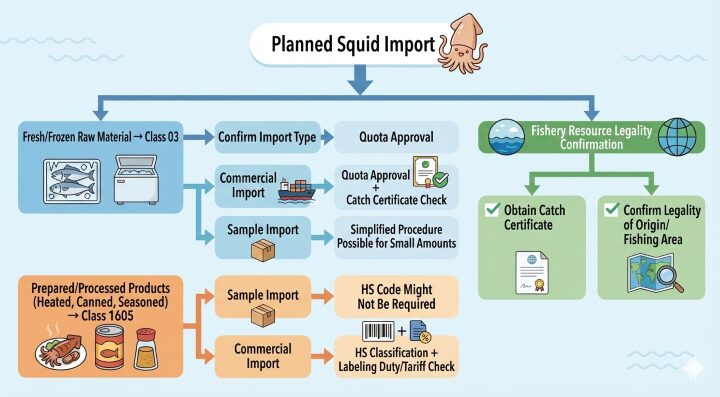

Practical Import Decision Flow (Simplified)

- Confirm product form: fresh/frozen raw material or processed product

- Confirm import purpose: sample or commercial

- Verify HS code (Chapter 03 or HS 1605)

- Check import quota requirements (HS 03 only)

- Confirm seafood legality compliance (Catch Certificate, COO, etc.)

- Submit customs declaration, verify duties, labeling, and documentation

Import Quota Procedures and Customs Clearance Flow

Practical Steps for HS Chapter 03 Raw Squid

| Step | Practical Notes |

|---|---|

| Import Quota Application | Filed with Japan Customs (under Ministry of Finance). Application deadline is typically ~2 weeks before the planned import date. Required documents include sales contract, planned quantities, and Certificate of Origin (COO). |

| Customs Declaration | Declare under HS Chapter 03 within approved quota limits. Quota approval number must be attached. |

| Inspection & Approval | Quantity, quality, and origin are verified at clearance. Catch Certificate and legality checks are conducted. |

Risk: Exceeding quota limits results in denial of clearance and potential additional duties (often ranging from hundreds of thousands to millions of yen).

Key Points for HS 1605 Prepared Squid Products

- Small sample imports may, in limited cases, be exempt from full HS coding

- For commercial imports, HS classification must reflect processing level, packaging, and heat treatment

- Commercial imports require submission of a Catch Certificate and Processing Statement under the seafood legality framework

- Errors in labeling or duty rates may require post-clearance corrections

👉 Related article: Definitive Guide to Food Import Preparation & Ingredient Labeling in Japan

Seafood Legality Compliance Checklist

Mandatory Items

- Catch Certificate

- Verification of legality of harvesting country and fishing area (e.g., ICCAT, CCAMLR compliance)

- Confirmation of compliance with Japanese domestic regulations (e.g., protected or endangered species)

Practical Tips

- Obtain and verify Catch Certificates before shipment

- Maintain a shared checklist with exporters and trading partners

Common Compliance Failures

- Converting sample imports into commercial sales → clearance suspension and reputational damage

- Incorrect HS code declaration → additional duties and statistical discrepancies

- Missing Certificate of Origin (COO) → legality compliance violations

- Misclassification due to mixed shipments → raw and processed products declared under one HS code

Practical Summary

For squid imports, the following three checks must always be performed together:

- HS classification (Chapter 03 or HS 1605)

- Applicability of import quota regulations

- Applicability of seafood legality and traceability requirements

Particular caution is advised in the following cases:

- First-time sourcing countries

- New products with ambiguous processing levels

- Conversion from samples to commercial imports

In such cases, prior consultation with a licensed customs broker or trade compliance specialist is strongly recommended.

👉 Related: How to Find HS Codes – 3 Common Mistakes Beginners Make

👉 Related: Complete Guide to Certificates of Origin (COO) for Food Imports

Practical Q&A

Q1. Are processed squid products (HS 1605) subject to seafood legality compliance even if they are not subject to import quotas?

A. Yes. Commercial imports are generally required to comply.

Squid is a regulated species under Japan’s seafood legality framework. Regardless of whether the product is raw (HS 03) or processed (HS 1605), importers are required to verify lawful harvesting. Even non-quota items require Catch Certificates and Processing Statements.

Q2. Are Catch Certificates required for “processed” or “heat-treated” squid?

A. In most cases, yes.

The presence or absence of processing or heat treatment does not affect applicability. Even for prepared products, documentation proving lawful harvesting of the raw squid and a Processing Statement describing the manufacturing process are typically required.

Q3. Do small-quantity sample imports fall under seafood legality regulations?

A. In principle, yes, but treatment depends on whether the import is non-commercial.

Imports strictly for testing or evaluation may be simplified. However, if samples are later diverted to commercial sale, the risk of regulatory violations is high. In practice, obtaining documentation from the outset is recommended.

Q4. Can Catch Certificates issued for EU exports be used for Japanese import procedures?

A. In some cases, yes, but content verification is essential.

If the EU-issued certificate contains all information required under Japan’s system—such as fishing country, fishing area, quantity, and processing details—it may be accepted. Otherwise, reissuance or supplemental documentation will be required.

Q5. How should compliance be handled when importing frozen raw squid and processed products together?

A. Each product must be handled separately.

Frozen raw squid (HS 03) is subject to both import quotas and seafood legality compliance, while processed products (HS 1605) are not subject to quotas but still require legality compliance. Mixed shipments must clearly separate HS codes, certificates, and declarations to avoid clearance delays.

Q6. What are the risks if non-compliance with seafood legality requirements is discovered?

A. Risks extend beyond customs suspension and can affect ongoing trade.

Deficiencies may result in clearance suspension, corrective orders, and additional document submissions. Repeated or serious violations can damage supplier credibility and disrupt future import operations.

References

- Japan Customs: HS Classification and Import Quota System for Seafood

https://www.customs.go.jp/english/tariff/index.htm?utm_source=chatgpt.com - Ministry of Agriculture, Forestry and Fisheries (Japan): Guidelines on Fisheries Resource Management and Import Legality

https://www.maff.go.jp/e/?utm_source=chatgpt.com - International Whaling Commission (IWC): Catch Documentation Schemes

https://www.jfa.maff.go.jp/e/whale/attach/pdf/index-22.pdf - FAO Fisheries and Aquaculture Department: International Trade of Cephalopods

https://www.fao.org/4/i3489e/i3489e.pdf?utm_source=chatgpt.com